By MIAMI Realtors® Chief Economist Gay Cororaton

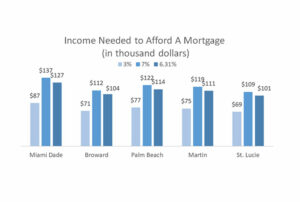

The 30-year mortgage rate fell for the fifth consecutive week during the week of December 15, 2022 to 6.31%. The mortgage rate fell as the Fed downshifted to a smaller 50 basis points rate increase after a series of 75 basis point hikes.

The sustained decline in the 30-year mortgage rate is starting to revive homebuying. Mortgage applications on a seasonally adjusted basis increased 4% in the week of December 9, according to the Mortgage Bankers Association.

The decline in mortgage rates means a more robust market for home sales in 2023. I expect home sales to post some uptick in 2023 compared to 2022 as mortgage rates continue to head downwards to 6% in 2023 amid decelerating inflation.

The reduction in mortgage rate saves households $150 to nearly $200 per month, resulting in a lower level of income needed to afford a home. A mortgage is affordable if the payment is no more than 25% of household income. In Miami Dade County, the income needed for a household to pay the mortgage affordably falls to about $127,000 from $137,000.

The South Florida home sales market is expected to do better than nationally given the stronger labor market conditions in the Miami metro area. As of October, the unemployment rate in the Miami-Fort Lauderdale-West Palm Beach metro area was 2.3% compared to 3.7% nationally.

Moreover, South Florida continues to attract people from high cost and high tax markets like New York and California. About 1 in 3 people who moved to Miami Dade County, Broward, Palm Beach and Martin County, and who exchanged their out-of-state licenses for a Florida license in 2021 came from California or New York, according to Florida Highway and Safety Motor Vehicles data compiled by Florida REALTORS®.