By Gay Cororaton, Chief Economist

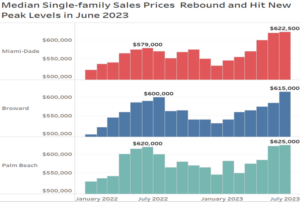

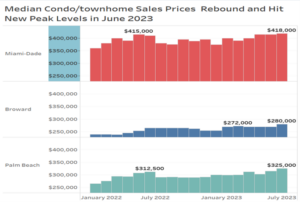

For the first time, the South Florida counties of Miami-Dade, Broward, and Palm Beach all hit new record highs in the median sales prices of single-family homes and condo/townhomes in June 2023. While home prices surpassed the prior peak level in 2022 in some counties starting in April this year, it is only in June 2023 when all three counties (Tri-County area) reached new record highs in both single-family and the condo/townhome market.

South Florida’s price resilience is in contrast to the national and regional trends. The national median sales price of existing homes is down nationally (-0.9%), in the South (-1.2%) and in the West (-3.4%), but prices are up in the Northeast (4.9%) and in the Midwest (2.1%).

Strong demand outpacing the supply of new listings is underpinning the rebound in home prices which had fallen in the second half of 2022 as mortgage rates rose. With mortgage rates likely to hit 7.5% by year end, new listings are likely to remain at their current low level, supporting a single-digit pace price appreciation in the second half.

Single-family homes sales prices

In Miami-Dade County, the median single-family sales price hit $ 622,500 in June, as home sales prices continued to consistently increase since January of this year, after briefly falling during October through December 2022. The new high is 7.5% higher than the last peak in June 2022 ($579,000), a level surpassed in April 2023 ($600,000). The year-over-year pace is the highest among the three counties.

In Broward County, the median single-family sales price rose to a record high of $615,000, up 3% from the last peak ($600,000) in July 2022. The median single-family sales price is up 4.2% year-over-year.

In Palm Beach County, ,the median single-family sales price reached the highest record high among the three counties, at $625,000, up 1% from the prior peak ($620,000), also in June last year, a level surpassed in May 2023 ($622,500). The median single-family sales price is up 0.8% year-over-year.

Condominium/townhomes sales prices

In Miami-Dade County, the median condo/townhome sales price rose to $418,000, up 1% from the previous peak and the second highest level in May 2022 ($415,000). Miami-Dade County had the highest record price among all the three counties. The median condo/townhome sales price is up 2% year-over-year.

In Broward County, the median condo/townhome sales price rose to $280,000, up 3% from the prior peak in February 2022 ($272,000). The median condo/townhome sales price is up 5.7% year-over-year, the highest pace among the three counties.

In Palm Beach County, the median condo/townhome sales price rose to a new record high of $325,000, up 4% from the prior peak in June 2022 ($312,500), a level surpassed in May ($315,000). The median condominium sales price is up 4% year-over-year.

Fewer new listings than pending sales

Fewer new listings and the decline in inventory of homes on the market since the beginning of the year is driving the rebound in home prices. With fewer new listings compared to pending sales, the level of inventory of single-family homes and condo/townhomes as of June 2023 has shrunk by 53% to 62% from the 2019 pre-pandemic peak levels (Miami-Dade, -62%; Broward, -53%; Palm Beach, -53%).

In Miami-Dade, there have been fewer listings than pending sales since December, with about nine new listings per ten new pending sales as of June 2023.

In Broward, there were fewer new listings than pending sales since December except in June 2023 with a little over ten new listings for every ten pending sales.

Palm Beach County appears to have less of a supply problem, with more new listings than pending sales. However, the ratio of new listings relative to pending sales has been on the decline as well, from 20 new listings per ten new pending sales in June 2022 to 14 new listings per ten new pending sales in June 2023.

The decline in inventory is acute for single-family homes below $400,000 – an affordable home price for households earning $100,000.[1] In Miami-Dade, only 4% of single-family homes active inventory is below $400,000 (from 37% in June 2019), or just 117 homes. The bulk of homes below $400,000 are condo/townhomes, making up 30% of active condo/townhomes listings (48% in June 2019), or 1,752 homes. The inventory of single-family homes is equivalent to about 2 months of the pace of monthly demand, while months’ supply of condo/townhomes is about 4 months.

On the other hand, active listings of homes over $1 million now make up 40% of single-family active listings (from 28% in June 2019) , or 1,417 homes. In the condominium market, $1 million or more homes now account for 30% (from 19% in June 2019), or 1,775 listings.

Demand is strong for properties across both price points. Homes below $400,000 are affordable to families earning $100,000, while homes in the $1 million or more price range attract high net worth cash buyers desiring the features of luxury homes. Cash buyers make up about 70% to 90% of the $1 million or more sales.

Across price points, supply is tight. For single-family homes at below $400,000 there is less than 2 months’ supply and less than 4 months’ supply for condo/townhomes in the three counties. In the $1 million or more market, there is about 7 to 12 months’ supply. A supply of 12 to 24 months is normal for $1 million or more properties, and 24 to 48 months’ supply is not unusual in Miami-Dade.

Prices likely to rise at single-digit pace in second half of 2023

Amid tight supply, the median sales prices will likely continue to rise at a single-digit pace in the second half of 2023.

While homeowners are seemingly adjusting very slowly to higher mortgage rates and locked into their low mortgage rate, buyers appear to be adjusting more quickly to the new reality of higher interest rates, competing for the limited supply, buoying up prices, and snapping up homes that suit their needs and if affordable, typically within a month after listing.

Strong job growth, migration from other states, and high net worth cash buyers have made South Florida’s housing market more resilient than nationally. Non-farm employment rose at 3.2% year-over-year in May, outpacing the national rate of 2.7%. In the first half of 2023, the total out-of-state and foreign driver licenses exchanged for a Florida license in the counties of Miami-Dade, Broward, Palm Beach, and Martin rose about 18% to 82,302 from the same period in 2022, according to driver license exchange data from the Florida Highway Safety and Motor Vehicles.[2] Cash buyers made up 40% to 50% of total single-family and condo/townhome sales in South Florida’s market in June 2023 compared to 26% nationally.

GET THE LATEST MARKET STATS AT South Florida Market Stats – June 2023 – MIAMI REALTORS®

[1] For this calculation, a mortgage payment is affordable if the mortgage payment is no more than 25% of the household income so that the total housing expenses (including taxes, insurance, maintenance) account for no more than 30% of income.

[2] South Florida Driver License Exchanges Rose 18% in 2023 Due to International Migration – MIAMI REALTORS®