By Gay Cororaton, Chief Economist

Mortgage rates are likely to bounce around the 6.5% to 7% range through the end of the year as financial markets anticipate a possible rate hike in September even if Chair Powell was neutral about a rate pause or increase after the 0.25% latest rate hike at the Fed’s July 25-26 meeting.

The GDP 2023 Q2 figures released today indicate that the economy is still resilient although weakening. The latest data on job openings and employment indicate a tight labor market although with more slack than before.

The recently released data and monthly inflation and employment data be released before the Fed’s September meeting means that mortgage rates will continue to bounce within the range of 6.5% to 7%. As of July 27, the Treasury bond rate touched the 4% mark, indicating that financial markets are baking in a rate increase.

Economy continues to expand in 2023 Q2, but growth is concentrated on few sectors

The expanded at a stronger annualized growth of 2.4% in 2023 Q2 (2.0% in Q1). Despite the increase in the overall GDP growth, an analysis of the GDP components shows a deceleration in growth among the components, with growth concentrated in very few sectors, namely transportation and software.

Consumer spending growth slowed to 1.6% (4.2% in Q1) as consumers cut back on spending for motor vehicles, dining outside, and clothing. However, the latest US Index of Consumer Sentiment of the University of Michigan rose to 72.6 in July, the highest reading since September 2021. Slowing inflation—now down to 3% as of July—could be contributing to this positive sentiment.

Gross domestic investment spending rose to 5.7% (-11.0% in Q1), but the growth was due to investment in equipment, specifically transportation equipment, and software. These increases could be associated with the continued growth of e-commerce spending and last-mile distribution, generative AI investments (e.g., ChatGPT), and hybrid or remote work. However, industrial equipment investment spending fell- which is an indicator of future manufacturing/production plans.

Residential investment spending continued to fall (-4%) . Housing starts on a seasonally adjusted basis as of June stood at 1.43 million from 1.56 million one year ago.

Labor market conditions remain tight due to post-Covid shifts in labor demand and supply

The labor market is still strong with more openings than unemployed, even if labor demand has weakened. As of May, there were 1.6 job openings for every unemployed (9.8 million openings, 5.987 million unemployed). The job openings ratio has declined from a high of 2.0 in March 2022 (12.027 million openings, 5,972 million unemployed).

Industries which have seen a strong rise in job openings are health care and services; leisure and hospitality (includes food services and accommodation) and transportation, warehousing, and utilities. The increase in job openings in these industries seems to be related to a structural shift in labor demand: an aging population needing health care services, the rise of e-commerce that has spurred the demand for warehousing/transportation, the continued normalization of travel and tourism, and possibly even the rise of hybrid or remote work that has enabled working at vacation destinations.

Another structural shift is the decline in the labor force participation rate. The labor force participation rate has been increasing, especially for 25-64 (83.1% pre-pandemic to 83.5%) so that will add to the labor force and ease wage pressures. But the overall LFPR is still below pre-pandemic (63.3% pre-pandemic to 62.6%) due to the large decline in the LFPR for 65 and over

(26% pre-pandemic to 23.3%).

So with the demand for labor due to the structural shifts (aging population, e-commerce, hybrid work) amid a lower labor force participation rate, wage growth could remain elevated above the 2-3% historic average, and the elevated wage growth could prop up inflation at over 2%. Chair Powell noted at the July meeting press conference that he expects wage pressures to play a more important role in the inflation trajectory than in the past where supply-side inflationary pressures have been mainly driven by COVID-induced supply distribution bottlenecks.

Mortgage Rate Outlook: Mortgage Rates to Tread at 6.5% to 7% in Second Half of 2023

Given the Fed’s laser focus on bringing down inflation to 2% Chair Powell’s remarks and these recent indicators that show the economy is still resilient, the financial markets are baking in another rate hike. As of July 27, the Treasury bond rate was hovering at 4%. The last time the bond rate went over 4% was in March 2023. With the Fed still open to rate hikes, mortgage rates will likely bounce around the 6.5% to 7% range from now through September.

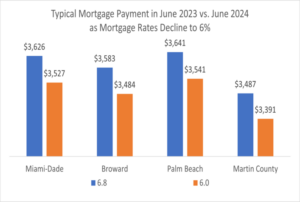

Mortgage rates will likely start coming down towards 6% by mid-year and 5.5% by the end of 2024 as inflation eases to 2.5%. The typical mortgage payment will fall by about $100 per month by June next year, assuming home prices rising at a single-digit pace of 5% and the 30-year fixed rate moves down to 6% by mid-year. Expect a stronger housing market in 2024 as mortgage payments fall next year.