MIAMI — Palm Beach County total home sales rose year-over-year as South Florida real estate continues to outperform the nation, according to October 2023 statistics released by the MIAMI Association of Realtors (MIAMI) and the Multiple Listing Service (MLS) system.

Palm Beach County home sales rose 3.8% year-over-year, from 1,927 to 2,001. The statistics don’t include South Florida’s robust developer new construction market and volume.

“Palm Beach real estate continues to prove its resiliency and strength in the wake of elevated mortgage rates,” JTHS-MIAMI President Martha Gillespie-Beeman said. “Palm Beach home sales, median prices, new listings, dollar volume and more increased last month.”

Palm Beach Single-Family Homes, Condo Transactions Increase

Palm Beach single-family home sales increased 3.5% year-over-year, from 1,049 in October 2022 to 1,086 in October 2023.

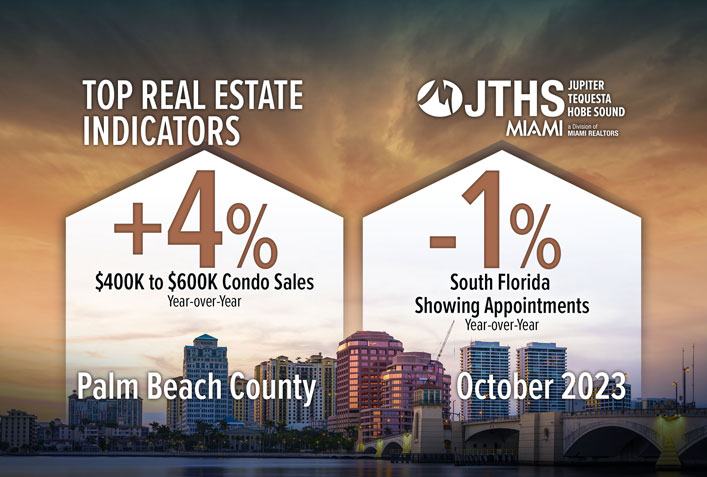

Palm Beach existing condo sales increased 4.2% year-over-year, from 878 in October 2022 to 915 in October 2023.

Palm Beach total pending sales rose 6.24% year-over-year in October 2023 to 1,940 transactions.

“Two telling indicators of the positive momentum are the increase in single-family pending sales and new listings in all the counties of Miami-Dade, Broward, Palm Beach, and Martin, something we have not seen since 2021 when mortgage rates were at historic lows,” MIAMI REALTORS Chief Economist Gay Cororaton said. “I think the housing market is poised for a strong comeback in 2024. Rising mortgage rates have gravely hurt affordability this year and that pent-up demand will show up next year.”

Total Palm Beach New Listings Increase

Palm Beach new listings increased 15.90% year-over-year in October 2023, from 2,938 to 3,405. The Palm Beach market remains in a seller’s market but the fresh supply of listings will give buyers more options.

Palm Beach single-family homes new listings increased 11.4% while Palm Beach condo new listings jumped 21.8% year-over-year.

Mortgage Rates Tumble for Third Consecutive Week with 6% Forecasted Rates in 2024

Home sales are sensitive to mortgage rates changes and after surging to near 8%, rates have declined for the past three weeks. National Association of REALTORS(R) Chief Economist Lawrence Yun said at last week’s NAR NXT conference that rates have peaked and will now head to the 6% range by spring 2024.

According to Freddie Mac, the 30-year fixed-rate mortgage averaged 7.44% as of November 16. That’s down from 7.50% the previous week but up from 6.61% one year ago.

Another leading indicator for sales are showing appointments. South Florida showing appointments declined 1% year-over-year in October 2023 to 181,633 appointments. South Florida showing appointments increased five consecutive months year-over-year before October 2023.

Palm Beach Inventory is Still Down From Historical Average

Total inventory is down 92% from the historical average for Palm Beach. The historical average for Broward existing inventory is 16,196 and current inventory is at 8,435.

Total active listings at the end of October increased 14.7% year-over-year, from 7,351 to 8,435.

Inventory of single-family homes decreased 1.4% year-over-year in October 2023 from 4,286 active listings last year to 4,224 last month. Condominium inventory increased 37.4% year-over-year from 3,065 to 4,211 listings during the same period in 2022.

Months’ supply of inventory for single-family homes is 3.6 months, which indicates a seller’s market. Inventory for existing condominiums is 4.2 months, which also indicates a balanced market. A balanced market between buyers and sellers offers between six- and nine-months supply.

Nationally, total housing inventory registered at the end of October was 1.15 million units, up 1.8% from September but down 5.7% from one year ago (1.22 million). Unsold inventory sits at a 3.6-month supply at the current sales pace, up from 3.4 months in September and 3.3 months in October 2022.

Palm Beach Home Price Appreciation Continues Surging

Palm Beach County single-family home median prices increased 9.3% year-over-year in October 2023, increasing from $570,000 to $622,733. Existing condo median prices increased 8.6% year-over-year from $290,000 to $315,000.

South Florida’s Incredible Wealth Migration

Local home prices have risen with South Florida’s wealth migration. In-migration boosted South Florida household income by $16 Billion in 2021, according to MIAMI REALTORS® analysis of the 2020-2021 migration data released by the Internal Revenue Service.

New households moving into Miami-Dade in 2021 had an average adjusted gross income of $229,300. New households moving into Broward County had an average adjusted gross income of $102,600. New households moving into Palm Beach County had an average adjusted gross income of $242,200.

Palm Beach Real Estate Posts $244 Million Local Economic Impact in October 2023

Every time a home is sold it impacts the economy: income generated from real estate industries (commissions, fees and moving expenses), expenditures related to home purchase (furniture and remodeling expenses), multiplier of housing related expenditures (income earned as a result of a home sale is re-circulated into the economy) and new construction (additional home sales induce added home production).

The total economic impact of a typical Florida home sale is $122,000, according to NAR. Palm Beach sold 2,001 homes in October 2023 for a local economic impact of $244 million.

Palm Beach total dollar volume totaled $1.45 billion in October 2023. Single-family home dollar volume increased 1.3% year-over-year to $986.3million. Condo dollar volume increased 33.1% year-over-year to $462.9 million.

Palm Beach Distressed Sales Remain Low, Reflecting Healthy Market

Only 0.8% of all closed residential sales in Palm Beach were distressed last month, including REO (bank-owned properties) and short sales lower than 0.9% in October 2022.

Short sales and REOs accounted for 0.09% and 0.8% year-over-year, respectively, of total Palm Beach sales in October 2023.

South Florida’s percentage of distressed sales are on par with the national figure. Nationally, distressed sales represented 2% of sales in October 2023, virtually unchanged from last month and the prior year.

South Florida Median Price Appreciation Outperforming Nation, State

In Florida, closed sales of single-family homes statewide totaled 19,729 in October 2023, down 5.3% year-over-year, while existing condo-townhouse sales totaled 8,115, down 2.9%. Closed sales may occur from 30- to 90-plus days after sales contracts are written.

Nationally, total existing-home sales transactions fell 4.1% from September to a seasonally adjusted annual rate of 3.79 million in October. Year-over-year, sales tumbled 14.6% (down from 4.44 million in October 2022).

The statewide median sales price for single-family existing homes was $410,000, up 2% from the previous year, according to data from Florida Realtors Research Department in partnership with local Realtor boards/associations. Last month’s statewide median price for condo-townhouse units was $321,990, up 3.9% over the year-ago figure. The median is the midpoint; half the homes sold for more, half for less.

Nationally, the median existing-home price for all housing types in October was $391,800, an increase of 3.4% from October 2022 ($378,800). All four U.S. regions registered price increases.

Palm Beach Real Estate Attracting Near List Price

The median percent of original list price received for single-family homes was 96.1% in October 2023. The median percent of original list price received for existing condominiums was 95.2%.

The median number of days between listing and contract dates for Palm Beach single-family home sales was 21 days, down from 28 days last year. The median time to sale for single-family homes was 64 days, down from 71 days last year.

The median number of days between the listing date and contract date for condos was 31 days, up from 27 days. The median number of days to sale for condos was 71 days, up from 69 days.

Palm Beach Cash Sales Nearly Double the National Figure

Cash sales represented 54.8% of Palm Beach closed sales in October 2023, compared to 48.6% in October 2022. About 29% of U.S. home sales are made in cash, according to the latest NAR statistics.

Cash buyers are not deterred by rising rates. The high percentage of cash buyers reflects South Florida’s top position as the preeminent American real estate market for foreign buyers, who tend to purchase with all cash as well as some moving from more expensive U.S. markets who can buy more with their profits from real estate sales.

Cash sales accounted for 63.1% of all Palm Beach existing condo sales and 47.9% of single-family transactions.

To access October 2023 Palm Beach Statistical Reports, visit http://www.SFMarketIntel.com

Note: Statistics in this news release may vary depending on reporting dates. MIAMI reports exact statistics directly from its MLS system.

About the MIAMI Association of Realtors®

The MIAMI Association of Realtors (MIAMI) was chartered by the National Association of Realtors in 1920 and is celebrating 103 years of service to Realtors, the buying and selling public, and the communities in South Florida. Comprised of six organizations: MIAMI RESIDENTIAL, MIAMI COMMERCIAL; BROWARD-MIAMI, a division of MIAMI Realtors; JTHS-MIAMI, a division of MIAMI Realtors in the Jupiter-Tequesta-Hobe Sound area; MIAMI YPN, our Young Professionals Network Council; and the award-winning MIAMI Global Council. MIAMI REALTORS represents nearly 60,000 total real estate professionals in all aspects of real estate sales, marketing, and brokerage. It is the largest local Realtor association in the U.S. and has official partnerships with 257 international organizations worldwide. MIAMI’s official website is www.MiamiRealtors.com

###